About the Company

Mindtree Limited is mid-cap international Information Technology consulting and Implementation Company that delivers business solutions through global software development. The Company was incorporated in August 1999 by 10 professionals with an initial funding of USD 9.1mn

from venture capital firms Walden International and Sivan Securities. Later on it became a public limited company on November 6, 2006 and the IPO was subscribed by 103 times. Currently, The Company has five direct and seven step down subsidiary. The Company is head quartered in Bangalore (India) and has 24 global offices with business operations spread across US, Europe & Asia Pacific. With 16,623 employees[1] from 48 different countries, The Company has developed long standing relationships with marquee 348[2] active clients which includes over 40 Fortune 500 companies such as Microsoft, Unilever, Avis Budget Group etc. The Company recently launched Global Learning & Software Delivery Centre in Bhubaneswar. The Company has exhibited exceptional leadership in the area of governance by winning the “Best Corporate Governance – Technology – Asia - 2015” and also voted as one of the 50 Happiest Companies in U.S. for 2016, and amongst the 100 “ Fastest Growing Companies” by BW Business world. The Company is recently recognized by Nelson Hall as a leader in Software Testing Services on the digital focus market segment.

from venture capital firms Walden International and Sivan Securities. Later on it became a public limited company on November 6, 2006 and the IPO was subscribed by 103 times. Currently, The Company has five direct and seven step down subsidiary. The Company is head quartered in Bangalore (India) and has 24 global offices with business operations spread across US, Europe & Asia Pacific. With 16,623 employees[1] from 48 different countries, The Company has developed long standing relationships with marquee 348[2] active clients which includes over 40 Fortune 500 companies such as Microsoft, Unilever, Avis Budget Group etc. The Company recently launched Global Learning & Software Delivery Centre in Bhubaneswar. The Company has exhibited exceptional leadership in the area of governance by winning the “Best Corporate Governance – Technology – Asia - 2015” and also voted as one of the 50 Happiest Companies in U.S. for 2016, and amongst the 100 “ Fastest Growing Companies” by BW Business world. The Company is recently recognized by Nelson Hall as a leader in Software Testing Services on the digital focus market segment.

Shareholding Pattern

Cat

Code

|

Category of

Shareholder

|

Number of

Shareholders

|

Total

number

of shares

|

Number of

shares held in

dematerialized

form

|

Total shareholding as a percentage of total

number of shares

|

A

|

SHAREHOLDING OF PROMOTER

AND PROMOTER GROUP

|

9

|

23085726

|

23085726

|

13.76

|

B

|

Public

Shareholding

|

||||

1.

|

INSTITUTIONS

|

||||

A

|

MUTUAL

FUNDS/UTI

|

50

|

10459261

|

10459261

|

6.23

|

B

|

Foreign

Portfolio Investors

|

104

|

19234195

|

19234195

|

11.46

|

B

|

Financial

institutions/Banks

|

5

|

82232

|

82232

|

0.05

|

C

|

Foreign institutional

investors

|

99

|

50874615

|

50874615

|

30.32

|

2.

|

NON- INSTITUTIONS

|

||||

A

|

Corporate

Bodies (Indian/foreign/Overseas)

|

714

|

34833058

|

34832858

|

20.76

|

B

|

Individuals

|

||||

(i)

|

Individual

shareholders holding Nominal share Capital up to Rs.2 lakh

|

63370

|

10768417

|

10501940

|

6.42

|

(ii)

|

Individual

shareholders holding Nominal share Capital above Rs.2 lakh

|

117

|

10269712

|

10220976

|

6.12

|

C

|

Any other(Clr-Mem,

Trusts, OBC etc)

|

3293

|

8178960

|

8077044

|

4.88

|

Total Public Share Holding (B)

|

67752

|

144700450

|

1442831121

|

86.24

|

|

TOTAL(A+B)

|

67761

|

167786176

|

167368847

|

100.00

|

Business Description

The Company is structured into five verticals – Retail, CPG and Manufacturing (RCM), Banking, Financial Services and Insurance (BFSI), Technology, Media and Services (TMS), formerly known as Hi-tech and Media Services (HTMS), Travel and Hospitality (TH) and others. Company derives its most of the revenue from U.S. business which is 64% of the total revenue of FY16 due to the acquisition of Discoverture Solutions L.L.C., Relational Solution, Inc. and Magnet 360, LLC which strengthens company’s capability to serve clients of in the Insurance industry and Consumer Goods Industry in U.S. During the year, The Company completed new offices in Bhubaneshwar and Washington according to the expansion plan of the management and also launched I Got Garbage (IGG): The technology platform for waste management for Bangalore citizens. Mr. Krishna kumar Natarajan who named among India’s Most Valuable CEO by BW Businessword has taken over as Executive Chairman while Mr. Rostow Ravanan who awarded Best CFO under the Consistent Liquidity Management (Medium) category has been designated as CEO & MD.

Services

The company derives its revenue from two main business segments: IT services that accounted for 72.6% of total revenue and Product Engineering & Services (PES) which is 27.4% of the total revenue. IT Services offer consulting and implementation and post production support for customers in manufacturing, financial services, travel and leisure and other industries, in the areas of e-business, data warehousing and business intelligence, supply chain management, ERP and maintenance and re-engineering of legacy mainframe applications. PE Services provides full life cycle product engineering, professional services, and sustained engineering services.

Service Process

In FY2011-12, Company went through an organizational

restructuring with the aim of focusing more on its core IT services business.

The company decided to operate predominantly in two segments —IT services and

product and engineering services (PES). IT services business would comprise of

four major verticals—banking and financial services and insurance (BFSI),

manufacturing, travel and transportation, amongst others. Similarly, under the

PES segment, Company consolidated its R&D services, software product

engineering services and its wireless units. Company’s 16 years of expertise in

digital world enables faster product realization by leveraging the expertise in

the areas of hardware design, embedded software, middle ware and testing and

through own IP building blocks in the areas of Bluetooth, VOIP, IVP6, iSCSI and

others in data com, telecom, wireless, storage, industrial automation,

avionics, consumer products and computing.

Industry Analysis

India’s cost competitiveness

in providing IT services, which is approximately 3-4 times cheaper than the

U.S., continues to be the world’s largest sourcing destination for information technology

(IT) industry, consisting of more than 16,000 firms, 1000+ MNCs and 4200+ tech start-ups.

During the year 2015, worldwide IT-BPM spends were USD 1.2 trillion, 0.4% up

from 2014 while Indian IT-BPM industry grew by 11 %

YoY with revenues of USD 132 billion. The Indian IT industry is expected to grow

10-12% per annum and triple its current revenues to reach USD 350 billion by

FY2025, as per NASSCOM because of faster growth of domestic segment due to

infusion of e-commerce, mobile app industry, and central government’s focus on

‘Digital India’ that includes the adoption of key technologies across sectors. Because of over 2000 digitally focused start-ups, larger firms is

expected to focus on the more innovation-collaboration which provide better

solution to the clients. Expertise developed in specific verticals is enabling

IT-BPM firms to deliver innovative products and services to the Indian

e-commerce segment. The IT industry will expand to USD 160 billion in fiscal

2016, which would include USD 108 billion in revenue from IT services exports,

USD 22 billion from the domestic market, USD 13 billion from IT hardware and

USD 17 billion from e-commerce.

Market Analysis

Indian IT-BPM market is nearby USD 132bn which is growing at the rate of a nearby 11% over YoY and contribution relative to India’s GDP is around 9.5%. In this highly competitive market, Company’s market capitalisation has increased from INR 16,060 Cr to INR 10,617 Cr i.e. sevenfold increase in the last five years. Company is showing a solid growth of 15.4% in dollar terms and 18.6% in constant currency terms thereby exceeding the NASSCOM estimate of 10.3% for FY16. To gain the competitive edge in the market, Company is focusing on emerging technology spaces like Cognitive computing and related technologies like machine learning, deep learning & predictive analytics, and also investing in reimagining engineering digital solutions using automation technologies and tools.Financial Analysis

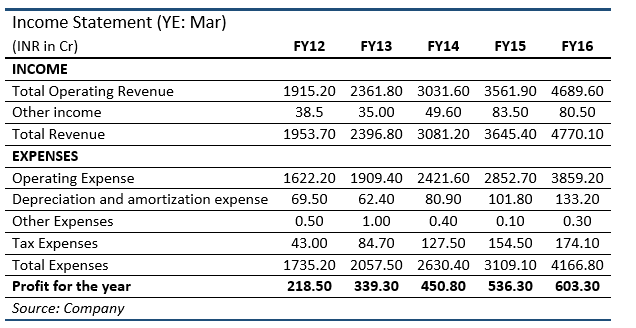

Mindtree has shown tremendous growth in the past 5 years. While its total assets have almost 2.5 times during the last five years, its non-current liabilities is increased by 205% in the last year because of the business acquisition like Magnet 360 LLC, Relational Solutions Inc. & Bluefin Solution. Its fixed assets increased by 120.18% from Rs. 555.50 crores in the previous year to Rs. 1223.10 crores in FY15-16 mainly on account of capitalization of Bhubaneshwar facility, consolidated goodwill of acquired businesses and also additions in computer systems, computer software and leasehold improvements. Its reserve and surplus is also increased by 15.51% in the current year. It’s Cash and Cash equivalent is increased 40% CAGR in the last five years and Cash generation during the year has also been healthy.

Mindtree has been

growing prodigiously. Inorganic Revenue from operating activities has increased

by 31.66% from Rs. 3561.90 crores in the previous year to Rs. 4689.60 crores in

FY2015-16, backed by strong growth in digital business grew at 37.6%. Its

operating expenses is increased by 35.28% in the FY16 while Consolidated EBITDA

margins have dropped to 17.7% in the FY16 due to lower margin profile of the

acquired business but this can be offset in nearby quarters as the businesses

are going to be synergized.

Mindtree reported

revenue growth of 9.01% QoQ because of lower growth from BFSI, and Retail, CPG

and Manufacturing (RCM) verticals. Net profit is increased by 3.38% in March

QoQ due to the 13.08% increase in the employee benefit expenses in March QoQ.

Profit & Loss Statement of last Three

Quarters

We

expect that Mindtree will grow ahead of the industry estimates in the nearby

future mainly because of strong deal wins and constant growth in digital

services. We have used Discounted Cash Flow method to arrive at a valuation for Mindtree. Our estimated value is

coming out to be around INR 723.67.

Price Performance

To download the report click here

About

the Author

This

report has been prepared by Jaymin Shah and published by Jayant Gupta, pursuing

MBA from Institute of Management, Nirma University located in Ahmedabad, India.

Disclaimer

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidelines only.

[1] Employees consist of Software Professionals(94%), Support Staff(5%)

and Sales Staff(1%) as of March 31,2016

[2] Client list is as of March 31, 2016

ReplyDeleteNice Article. Thank you for sharing the informative article with us.

smart investor

small-cap

Nice Article. Thank you for sharing the informative article with us.

ReplyDeleteThis post is helpful to many people. stockinvestor.in is a stock related website which provides all stocks related information like new stocks and shares available in the stock market.

Bombay stock exchange

nifty50

Nice Article. Thank you for sharing the informative article with us.

ReplyDeleteThis post is helpful to many people. stockinvestor.in is a stock related website which provides all stocks related information like new stocks and shares available in the stock market.

Bombay stock exchange

nifty50

Nice Article. Thank you for sharing the informative article with us.

ReplyDeletesmart investor

small-cap

Nice Article. Thank you for sharing the informative article with us.

ReplyDeleteThis post is helpful to many people. stockinvestor.in is a stock related website which provides all stocks related information like new stocks and shares available in the stock market.

traded stocks

market capitalization