About the Company

Aurobindo

Pharma Limited is a public pharmaceutical

manufacturing organization headquartered in Hyderabad, India. The company fabricates

generic pharmaceuticals and active pharmaceutical ingredients. It was established

in 1986 by Mr. P. V. Ramaprasad Reddy and Mr. K. Nityananda Reddy. The company initiated

operations in 1988-89 with a single unit producing Semi-Synthetic Penicillin

(SSP) at Pondicherry. Aurobindo Pharma became a public company in 1992 and

listed its shares in the Indian stock exchanges in 1995.

The company’s area of activity incorporates six major product areas: antibiotics, anti-retroviral, cardiovascular products, central nervous system products, gastroenterological, and anti-allergic. Aurobindo Pharma highlights among the top 10 enterprises in India in terms of consolidated revenues. The National Long–term Fitch Rating of the Company has been upgraded to 'IND AA' from 'IND AA–' showing stable standpoint of the Company.

The company’s area of activity incorporates six major product areas: antibiotics, anti-retroviral, cardiovascular products, central nervous system products, gastroenterological, and anti-allergic. Aurobindo Pharma highlights among the top 10 enterprises in India in terms of consolidated revenues. The National Long–term Fitch Rating of the Company has been upgraded to 'IND AA' from 'IND AA–' showing stable standpoint of the Company.

Shareholding Pattern

Aurobindo

Pharma Ltd. is a vertically integrated pharmaceutical company that delivers

innovative solutions. From discovery to development to commercialization, their

growth is aided by cost-effective drug development and substantial

manufacturing. It is one of the well-known global suppliers of generic

Antiretroviral (ARV) drugs. It focuses on high customer centricity. Its

products are updated continuously to suit the changing needs of its customers.

It market’s more than 300 products in over 125 countries. It is building and

establishing its brand as it gain’s significant strengths in chosen markets. It

has strategic alliances with global pharmaceutical majors to cater to their

formulation manufacturing needs. Thus, Aurobindo has a sustainable setup of

alliances and partnerships across the globe. The company has carved a niche for

itself in the global regulated market.

Aurobindo is

power-driven by its subsidiary model. The brilliance and hard work of its

global workforce, stellar track record, ever-growing infrastructure and

cost-competitiveness has well positioned it to overcome the challenges

normally associated with the pharma industry.

Product

Aurobindo is determining its

future, by guaranteeing sustainable development with niche and differentiated

basket of products, offering the elevated product quality while being cost

focused, to address the issues of customers and patients. It has a product

existence in key therapeutic segments like SSPs, cephalosporin’s, antivirals,

CNS, cardio–vascular, gastroenterology, etc. The company is the business sector pioneer in

semi–synthetic penicillin drugs.

Formulation–

In this section it manufactures formulation for cardio vascular, central

nervous system, gastroenterological, anti–retroviral and anti–invective’s. It

has created formulations specifically Trandolapril, Captopril, Benazepril

Hydrochloride, etc.

Active Pharmaceutical

Ingredients (API) – Aurobindo’s five units

for APIs and four units for formulations are designed for the regulated

markets.

Organic Intermediates–

It produces wide range of organic intermediates namely Desmethyl

Azithromycin, Methanamine, Benz imidazole, ECPPA and many more.

Geographical Presence

Aurobindo Pharma has distinguished

worldwide operations, taking into account more than 100 nations, as a major

engine of growth and extending worldwide system of advertising and assembling

operations across countries such as China, Brazil, Japan, Netherlands, South

Africa, Thailand, UK, USA, Russia, Netherlands and numerous more which will

expand its international reach. It has set up abroad branches/representatives

offices situated in Ethiopia, Tanzania, Kenya, Uganda, Italy, Ghana, Vietnam,

and United Kingdom. Aurobindo exports to more than 125 nations over the globe

with more than 70% of its incomes derived out of worldwide operations. Its

promoting accomplices incorporate AstraZeneca and Pfizer. In 2014, Aurobindo

bought the generic operations of Actavis in 7 Western European nations for

$41 million. In 2011 Aurobindo Pharma received Platinum Certificate of

Outstanding Exports Award from Pharmexcil.

Industry Analysis

The Indian

pharmaceutical industry is 3rd largest in terms of volume and 10th

largest in terms of value. This demonstrates the

way that India gives world class generics

at a low-cost. India is the largest supplier of generic drugs globally

with the Indian generics representing 20 per cent of global exports in terms

of volume. India enjoys a significant position in the global pharmaceuticals

sector. The country also has an expansive pool of researchers and specialists

who can possibly direct the business ahead to a much larger amount. India exports drugs to almost all crucial

pharmaceutical markets including mature ones such as US, European Union and

Japan. The Indian pharmaceutical industry has been developing at an

intensified yearly development rate of more than 15% over the last five years and has significant growth opportunities.

(PwC-CII). The Addendum 2015 (by IPC) is projected to play an

important role in upgrading the nature of prescriptions that would thusly

advance general wellbeing and quicken the development and improvement of

pharmaceutical area.

Market Analysis

Aurobindo Pharma highlights among

the top 10 endeavours in India in terms of consolidated revenues. It has

developed as the 10th largest and fastest growing organization in

the US (by prescriptions). Itis the business

sector pioneer in Semi-Synthetic penicillin

and stands among the top pharma companies in India. Itis targeting an income of over $ 3 billion (over Rs

19,800 crores) by 2017-18 and plans to grow its basket with new drugs to

treat cancer and hormonal

diseases, as also with various nutraceuticals and Over the Counter (OTC)

products. Aurobindo has additionally created and made filings for four

items in injectable portfolio that are controlled in the pre-working

procedure. It is working towards recording one more item inside of the

following 12 months The addressable market for all five products is $ 400

million in the US. Firstly, the products are likely to be launched in Brazil

and Mexico in 2016. The organization is

additionally investigating entering Nano spheres which have a much bigger

business sector, where the items have an addressable business sector of about

$ 3 billion in the US.

|

Financial

Analysis

Aurobindo Pharma has shown tremendous

growth in the past 5 years. Its total assets have grown by more than 100%

during the last five years. Its total assets increased by 36.09 % from Rs.

9489.82 crores in the previous year to Rs. 12914.48 crores in 2014-15 whereas

total liabilities increased by 35.33 %, from Rs. 5714 crores to Rs. 7732.75

crores. Aurobindo Pharma has debt/equity ratio of 0.75 and its reserves and surplus

has increased from Rs. 3721 crores in the previous year to Rs. 5126.71 crores

in 2014-15. Current assets have increased from Rs. 5631.18 crores to Rs. 8298.80

crores. Less debt and sufficient working capital shows good signal about the

company.

Consolidated Balance Sheet Last 5 years

(Rupee in crores)

|

Mar-11

|

Mar-12

|

Mar-13

|

Mar-14

|

Mar-15

|

EQUITY AND LIABILITIES

|

|||||

Share capital

|

29.11

|

29.11

|

29.12

|

29.15

|

29.20

|

Reserves and surplus

|

2415.72

|

2310.54

|

2576.64

|

3721.00

|

5126.71

|

Non-current liabilities

|

658.96

|

982.93

|

1,236.26

|

1,519.63

|

1,622.17

|

Trade payables

|

776.35

|

660.14

|

968.74

|

1351.20

|

2051.12

|

Other current liabilities

|

1,992.14

|

2,254.91

|

2,467.08

|

2,868.84

|

4,085.28

|

TOTAL

|

5872.28

|

6237.63

|

7277.84

|

9489.82

|

12914.48

|

ASSETS

|

|||||

Fixed assets

|

2,396.02

|

2,840.06

|

2,857.38

|

3,031.39

|

4,125.27

|

Other non-current assets

|

155.08

|

133.53

|

283.71

|

827.25

|

490.41

|

Inventories

|

1,455.27

|

1,545.56

|

1,923.59

|

2,367.54

|

3,611.30

|

Trade receivables

|

1,230.98

|

1,239.96

|

1,596.98

|

2,636.57

|

3,539.17

|

Cash and cash equivalents

|

186.72

|

70.86

|

208.45

|

178.58

|

469.11

|

Other current assets

|

448.21

|

407.66

|

407.73

|

448.49

|

679.22

|

TOTAL

|

5,872.28

|

6,237.63

|

7,277.84

|

9,489.82

|

12,914.48

|

Aurobindo Pharma has been growing

consistently. Revenue from operating activities has increased by 49.64 % from

Rs. 8099.79 crores in the previous year to Rs. 12120.52 crores in 2014-15. Net profit

has increased by 34.35 % during the same period, from Rs. 1172.85 crores to Rs.

1575.77 crores. Net profit has a Compounded Annual Growth Rate of 29.32 % for

the last 5 years. That indicates a high

growth rate for the company. Cash conversion cycle of Aurobindo Pharma has

decreased from 195.15 days in the previous year to 178.40 days in 2014-15.

Consolidated Profit and Loss Statement

Last 5 years

(Rupee in crores)

|

Mar-11

|

Mar-12

|

Mar-13

|

Mar-14

|

Mar-15

|

INCOME

|

|||||

Total Operating Revenue

|

4,381.48

|

4,627.40

|

5,855.32

|

8,099.79

|

12,120.52

|

Other income

|

71.41

|

24.70

|

28.54

|

23.24

|

96.71

|

Total Revenue

|

4,452.89

|

4,652.10

|

5,883.86

|

8,123.03

|

12,217.23

|

EXPENSES

|

|||||

Operating Expense

|

3418.22

|

4066.1

|

4994.37

|

5967.82

|

9556.9

|

Depreciation and amortization expense

|

171.50

|

200.53

|

248.74

|

312.53

|

332.61

|

Finance cost

|

64.65

|

277.24

|

266.64

|

310.16

|

159.87

|

Tax Expenses

|

235.85

|

233.01

|

85.17

|

367.23

|

601.10

|

Total Expenses

|

3,890.22

|

4,776.88

|

5,594.92

|

6,957.74

|

10,650.48

|

Profit for the year

|

562.67

|

-124.78

|

288.94

|

1,165.29

|

1,566.75

|

Operating revenue has increased by 4.63 %

from Rs. 3280.11 crores in September quarter of financial year 2015-16 to Rs.

3432.08 crores in December quarter of 2015-16. The growth is low because of

price pressure.

Profit & Loss Statement of last five

Quarters

Particulars(In

Crore Rs)

|

Dec'14

|

March'15

|

June'15

|

Sep'15

|

Dec'15

|

Income

from operations:

|

|||||

Net sales

|

3142.46

|

3143.97

|

3263.72

|

3280.11

|

3432.08

|

Other

operating income

|

23.7

|

18.1

|

56.64

|

53.36

|

63.42

|

Total income

from operations

|

3166.16

|

3162.07

|

3320.36

|

3333.47

|

3495.5

|

Expenses;

|

|||||

Cost of

materials consumed

|

1131.29

|

1032.34

|

1198.45

|

1155.06

|

1238.97

|

Purchases

of stock-in-trade

|

452.13

|

336.57

|

323.48

|

338.23

|

377.48

|

Changes in

inventories

|

-96.75

|

4.69

|

-14.1

|

-24.27

|

-62.9

|

Employee

benefit expense

|

334.71

|

373.32

|

365.08

|

375.92

|

401.02

|

Depreciation

and amortization expense

|

67.26

|

84.67

|

89.11

|

92.77

|

99.47

|

Other

expenses

|

732.61

|

759.06

|

722.8

|

712.94

|

717.92

|

Total

expenses

|

2621.25

|

2590.65

|

2684.82

|

2650.65

|

2771.96

|

Profit

from operations

|

544.91

|

571.42

|

635.54

|

682.82

|

723.54

|

Other

income

|

35.92

|

6.74

|

29.11

|

11.66

|

6.87

|

Profit

from ordinary activities

|

580.83

|

578.16

|

664.65

|

694.48

|

730.41

|

Finance

cost & Foreign exchange gain/loss

|

42.09

|

21.41

|

46.43

|

81.97

|

9.77

|

Profit

before tax

|

538.74

|

556.75

|

618.22

|

612.51

|

720.64

|

Tax

expense

|

156.34

|

153.4

|

186.53

|

162.2

|

185.99

|

Profit

after tax

|

382.4

|

403.35

|

431.69

|

450.31

|

534.65

|

Minority

interest

|

-1.95

|

-0.45

|

-0.75

|

-1.45

|

-0.3

|

Net profit

|

384.35

|

403.8

|

432.44

|

451.76

|

534.95

|

The pharmaceutical industry has a stable

future as per our analysis and understanding. Given Aurobindo Pharma’s growth

history, this company would grow with the industry and remain one step ahead of

the industry. Using the discounted cash flow method, we project the stock price

of Aurobindo Pharma to be around Rs. 1076.

Consolidated Balance Sheet

Projected 5 Years

(Rupee in crores)

|

Mar-16

|

Mar-17

|

Mar-18

|

Mar-19

|

Mar-20

|

Terminal

|

EQUITY AND LIABILITIES

|

||||||

Share capital

|

29.20

|

29.20

|

29.20

|

29.20

|

29.20

|

29.20

|

Reserves and surplus

|

6828.50

|

8663.73

|

10641.86

|

12772.25

|

15063.98

|

17375.95

|

Non-current liabilities

|

1622.17

|

1622.17

|

1622.17

|

1622.17

|

1622.17

|

1622.17

|

Current Liabilities

|

5956.56

|

6143.68

|

6349.52

|

6575.95

|

6825.02

|

6962.00

|

TOTAL

|

14436.4

|

16458.8

|

18642.8

|

20999.6

|

23540.4

|

25989.3

|

ASSETS

|

||||||

Fixed assets

|

4631.32

|

5187.85

|

5806.97

|

6502.82

|

7291.96

|

8193.83

|

Other non-current assets

|

490.27

|

490.27

|

490.27

|

490.27

|

490.27

|

490.27

|

Inventories

|

3288.36

|

3617.20

|

3978.92

|

4376.81

|

4814.49

|

5055.22

|

Trade receivables

|

3396.66

|

3736.32

|

4109.95

|

4520.95

|

4973.05

|

5221.70

|

Cash and cash equivalents

|

1970.11

|

2767.43

|

3596.93

|

4449.01

|

5310.88

|

6368.60

|

Other current assets

|

659.57

|

659.57

|

659.57

|

659.57

|

659.57

|

659.57

|

TOTAL

|

14,436.29

|

16,458.64

|

18,642.61

|

20,999.43

|

23,540.22

|

25,989.19

|

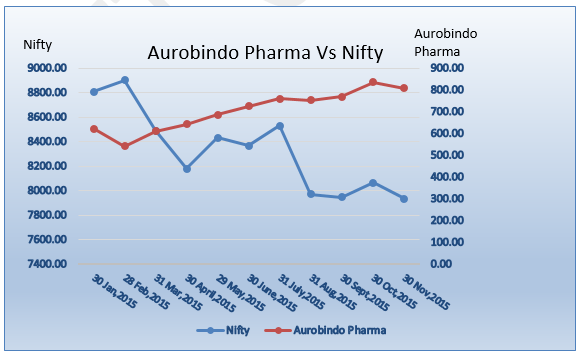

Price Performance

To download the complete report click here

References

About the Author

This

report has been prepared by Saumya Mehta and Abhishek Gulyani and published by

Jayant Gupta. They are pursuing MBA from Institute of Management, Nirma

University located in Ahmedabad, India.

Disclaimer

This document is

solely for the personal information of the recipient, and must not be

singularly used as the basis of any investment decision. Nothing in this

document should be construed as investment or financial advice. Each recipient

of this document should make such investigations as they deem necessary to

arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks

involved), and should consult their own advisors to determine the merits and

risks of such an investment.

The information in this document has been

printed on the basis of publicly available information, internal data and other

reliable sources believed to be true, but we do not represent that it is accurate

or complete and it should not be relied on as such, as this document is for

general guidelines only.

Please visit here IKEA Customer Feedback Survey wants to hear you all about your visit experience through the IKEA Customer Feedback Survey. Your opinion in IKEA Feedback Survey will be used to improve their customer service.

ReplyDelete