About the Company

Tata

Elxsi founded in 1989 is a design company that blends technology, creativity and

engineering to help customers transform ideas into world-class products and

solutions.

A part

of the $100 billion Tata group, it addresses the communications, consumer

products, defence, healthcare, media & entertainment, semiconductor and

transportation sectors. This is supported by a network of design studios,

development centres and offices worldwide.

Tata

Elxsi is uniquely positioned with its proven capabilities in technology and

user experience, insight-led design and product engineering across multiple

industries. It leverage these unique intersections to help customers create

exceptional products, services and experiences and drive their strategic growth.

Shareholding Pattern

Cat Code

|

Category of Shareholder

|

Total number of shares

|

Number of shares held in dematerialized form

|

Total shareholding as a percentage of total

number of shares

|

A

|

SHAREHOLDING OF PROMOTER AND PROMOTER GROUP

|

1,39,97,288

|

1,39,97,288

|

44.95

|

B

|

Public Shareholding

|

|||

1

|

INSTITUTIONS

|

|||

A

|

MUTUAL FUNDS/UTI

|

2,15,028

|

2,14,828

|

0.69

|

B

|

Financial institutions/Banks

|

21,654

|

21,454

|

0.07

|

C

|

Insurance

Companies

|

7,96,339

|

7,96,339

|

2.56

|

D

|

FII

|

25,39,203

|

25,36,903

|

8.15

|

2

|

NON- INSTITUTIONS

|

|||

A

|

Corporate Bodies (Indian/foreign/Overseas)

|

21,21,710

|

21,17,809

|

6.81

|

B

|

Individuals

|

|||

(i)

|

Individual shareholders holding Nominal share

Capital up to Rs.1 lakh

|

92,70,143

|

77,18,292

|

29.77

|

(ii)

|

Individual shareholders holding Nominal share Capital above Rs.1 lakh

|

21,66,645

|

21,66,645

|

6.96

|

C

|

Others

|

10210

|

10210

|

0.03

|

Total Public Share Holding (B)

|

1,71,40,932

|

1,55,82,480

|

55.05

|

|

TOTAL(A+B)

|

3,11,38,220

|

2,95,79,768

|

100

|

Key Services

Embedded Product Design

Tata Elxsi provide technology consulting, product development

and testing services for leading product companies, service providers and

start-ups. This is backed by an in-depth understanding of technology, a large

multi-disciplinary product development team, mature processes and systems. They

also create and license intellectual property and software components; helping

customers create product differentiation and reduce development costs and

time-to-market.

The company offers electronics,

software development and system design services for the automotive and

aerospace industry, address the complete product development lifecycle from

R&D, new product development and testing to maintenance engineering for

Broadcast and Consumer Electronics.

Industrial Design

Tata Elxsi help customers develop successful brands and products by

using design as a strategic tool for business success. Its services include

research & strategy, branding & graphic design, product design,

packaging design, UI design, retail design & signage, transportation

design, design engineering and prototype development. They have supported the

launch of multiple brands and

products across the world, winning various

international awards and patents for design and innovation. The company serves a broad spectrum of industries including automotive, consumer

electronics, retail & consumer goods and healthcare.

Visual Computing Labs

Tata Elxsi provides animation and visual

effects (VFX) services for feature films and episodic television. It also

support advertising and marketing by providing these services for TV

commercials and corporate videos for visualization and new product launches.

They develop custom content for visualization and product marketing. We

have executed several audio-visual films for use in promotional and launch

events, concept showcases to management or customers and advertising. We have

executed several prestigious projects for customers in the automotive, consumer

electronics, real estate and hospitality industries.

Systems Integration

Tata Elxsi implement and integrate

complete systems and solutions for broadcast, CAD/CAM/CAE/PLM, disaster recovery,

high-performance computing, storage and virtual reality. It also provides Professional Services, maintenance and

support services for data mining, storage, IT facilities and network management

in India and overseas.

Tata Elxsi implement and integrate

complete systems and solutions for broadcast, CAD/CAM/CAE/PLM, disaster recovery,

high-performance computing, storage and virtual reality. It also provides Professional Services, maintenance and

support services for data mining, storage, IT facilities and network management

in India and overseas.Top Management

Chairman

N.

Ganapathy Subramaniam is the Chairman of Tata Elxsi. He is the Executive Vice

President at Tata Consultancy Services Ltd. and head of TCS Financial

Solutions, a strategic business unit of TCS. He is the newly appointed

additional director and Chairman of the board, appointed on November 01, 2014.

He takes over the role of Chairman from Mr. S. Ramadorai, who stepped down from

the Board of Directors of the Company, on attaining the age of 70 years as per

the Company's policy. He is part of TCS and the Indian IT Industry for over 30 years.

Managing Director

Mr. Madhukar Dev is the Managing Director of Tata Elxsi. He

has over 30 years of industry experience, including 20 years in Sales &

Marketing. He joined Tata Elxsi in 1991, and since then has held various positions

in Sales & Marketing. He has been instrumental in nurturing the company’s

economic, professional and, most importantly, intellectual growth. Prior

to joining Tata Elxsi, Madhukar has worked in industries spanning Information

Technology, Power Electronics and Publishing where his work experience included

roles in Field Sales, Product Management and Market Development. Madhukar

is a qualified MBA from IIM Bangalore and has also completed his M.Sc. in

Physics.

Business Description

Tata Elxsi is an engineering

services company with presence in various industries such as Aerospace and defence,

Automotive, Broadcast and media, Communications, Consumer Products, Healthcare

and semiconductors. The main focus area of company is automotive sector. It

provides various services like verification and validation, rapid prototyping,

hardware designing, model based designing, embedded coding, process and domain

consultancy etc. It also has significant business in the area of communication,

broadcast and media and visual effects.

Industry

Analysis

Tata Elxsi is an

engineering services company with the presence in various industries such as

Aerospace and defence, Automotive, Broadcast and media, Communications,

Consumer Products, Healthcare and semiconductors. The global aerospace and defence

(A&D) industry is expected to return to growth in 2016 with total sector

revenues estimated to grow at 3.0 percent, according to the Deloitte Ltd. According to SIAM (Society of Indian Automobile

Manufacturers), the automobile industry

in India registered a growth of 8.68% in the year 2014-15.So there is a huge

opportunity in this sector for future growth. India’s

animation industry generated revenue worth Rs.4490 crore in 2014, a 13% increase from the previous

year, according to data from a FICCI-KPMG report on India’s media and

entertainment industry. The industry is expected to double in size to Rs.9550

crore within five years, as Hollywood studios tap a large pool of low-cost,

English-speaking animators who are familiar with Western culture.

Market Analysis

Tata Elxsi operates in

various fields such as industrial design, visual labs, embedded product design

and system integration. It main sources of revenues are from design of

infotainment systems for automobiles and visual labs. The strength for Tata

Elxsi is its global presence in all the above industries. Also Tata Elxsi is

leader in visual effects industry in India. So currently it is incumbent in

this industry. There is no immediate threat from local competitor in

infotainment industry and visual labs business. The Company might face threat

from various new entrants in the emerging markets which can take away the

business. The company’s visual effects business might face the threat of

substitutes like Virtual Reality and Augmented Reality.

Financial Analysis

Tata Elxsi has grown phenomenally

in the past 5 years. It has zero long term and short term borrowings which

shows that the financial health of company is good. The cash conversion cycle

of company has reduced from 33.46 days in 2011-12 to 22.23 days in 2014-15. The

Return on Capital Employed (RoCE) increased from 24.09% in 2010-11 to 40.22% in

2014-15 which means that the efficiency with which the company utilizes its

money has doubled in 5 years. Company’s Cash and Cash equivalents has increased

more than 6 times in past 5 years from 20.80 crores in 2010-11 to 133.26 crores

in 2014-15. It shows that the company does not have cash crunch in short term

and has enough working capital to meet its requirements.

Balance Sheet of Last 5 Years

(Rupee in crores)

|

2010-11

|

2011-12

|

2012-13

|

2013-14

|

2014-15

|

EQUITY AND LIABILITIES

|

|||||

Share capital

|

31.14

|

31.14

|

31.14

|

31.14

|

31.14

|

Reserves and surplus

|

151.23

|

160.84

|

164.04

|

204.57

|

252.29

|

Non-current liabilities

|

8.36

|

10.61

|

9.53

|

11.95

|

10.76

|

Trade payables

|

41.03

|

46.85

|

52.46

|

64.22

|

66.15

|

Other current liabilities

|

69.91

|

85.45

|

106.23

|

76.73

|

105.19

|

TOTAL

|

301.68

|

334.62

|

363.39

|

388.61

|

465.53

|

ASSETS

|

|||||

Fixed assets

|

90.75

|

99.88

|

99.14

|

96.83

|

98.49

|

Other non-current assets

|

61.64

|

60.90

|

75.70

|

53.26

|

38.78

|

Inventories

|

0.57

|

0.02

|

0.31

|

0.00

|

0.29

|

Trade receivables

|

107.23

|

125.65

|

140.98

|

155.61

|

154.08

|

Cash and cash equivalents

|

20.80

|

26.72

|

23.30

|

51.45

|

133.26

|

Other current assets

|

20.96

|

21.45

|

23.97

|

31.22

|

40.62

|

TOTAL

|

301.68

|

334.62

|

363.39

|

388.61

|

465.53

|

The company’s total

revenue has increased 19.38% CAGR in past 5 years while its profitability has

increased by 33.07% CARG in these years. The company’s operating expenses also

dropped from 88.65% in 2010-11 to 79.12% in 2014-15. All these things shows

that company’s operations have become more efficient and as a result

profitability has increased.

Profit

& Loss Statement for Last Five Years

(Rupee in crores)

|

2010-11

|

2011-12

|

2012-13

|

2013-14

|

2014-15

|

INCOME

|

|||||

Total Operating Revenue

|

415.91

|

538.71

|

621.67

|

774.78

|

849.40

|

Other income

|

3.86

|

4.20

|

4.84

|

12.54

|

3.35

|

Total Revenue

|

419.77

|

542.91

|

626.51

|

787.32

|

852.75

|

EXPENSES

|

|||||

Operating Expense

|

368.70

|

464.70

|

549.61

|

638.23

|

672.08

|

Depreciation and amortization

expense

|

17.20

|

20.52

|

23.73

|

34.99

|

25.54

|

Other Expenses

|

1.88

|

6.44

|

4.97

|

1.83

|

0.00

|

Tax Expenses

|

-0.55

|

16.65

|

10.99

|

39.92

|

53.10

|

Total Expenses

|

387.24

|

508.31

|

589.31

|

714.97

|

750.73

|

Profit for the year

|

32.53

|

34.60

|

21.31

|

72.35

|

102.02

|

This

industry has a bright future as per our analysis and understanding. Given Tata

Elxsi growth history, this forecasted bright future of this industry should

only propel this company forward. Using the discounted cash flow method, we

project the stock price of Tata Elxsi to be Rs. 3172.

Profit

& Loss Statement of last Two September Quarters

(Rs in Crores)

|

Sept 2014

|

Sept 2015

|

REVENUE

|

||

Net Sales (Net of excise duty)

|

205.88

|

263.65

|

Other Operating Income

|

0.00

|

0.00

|

Total Income from

Operations (Net) (1)

|

205.88

|

263.65

|

Other Income (2)

|

1.31

|

2.71

|

Total Revenue (1) +

(2)

|

207.19

|

266.36

|

EXPENSES

|

||

Costs of Materials Consumed

|

16.79

|

17.33

|

Changes in inventories of

finished goods, WIP

|

-0.05

|

0.00

|

Employee Benefit Expenses

|

113.97

|

143.57

|

Other Expenses

|

33.37

|

41.46

|

Operating Expense (3)

|

164.08

|

202.36

|

Depreciation & Amortization

(4)

|

7.87

|

5.68

|

Other Expenses (5)

|

0.00

|

0.00

|

Total Expenses (3) + (4) + (5)

|

171.95

|

208.04

|

Interest Expense

|

0.00

|

0.00

|

Profit Before Tax

|

35.24

|

58.32

|

Tax Expenses

|

11.59

|

20.21

|

Profit After Tax

|

23.64

|

38.09

|

Projected Balance Sheet for Next 5

Years

(Rupee in crores)

|

2016

|

2017

|

2018

|

2019

|

2020

|

EQUITY AND

LIABILITIES

|

|||||

Share capital

|

31.14

|

31.14

|

31.14

|

31.14

|

31.14

|

Reserves and surplus

|

359.75

|

472.35

|

590.07

|

712.88

|

840.76

|

Non-current liabilities

|

10.76

|

10.76

|

10.76

|

10.76

|

10.76

|

Trade payables

|

69.43

|

71.57

|

75.08

|

77.44

|

81.18

|

Other current liabilities

|

105.19

|

105.19

|

105.19

|

105.19

|

105.19

|

TOTAL

|

576.28

|

691.02

|

812.24

|

937.42

|

1069.02

|

ASSETS

|

|||||

Fixed assets

|

94.26

|

91.65

|

90.81

|

91.92

|

95.17

|

Other non-current assets

|

38.35

|

38.35

|

38.35

|

38.35

|

38.35

|

Inventories

|

0.01

|

0.30

|

0.02

|

0.32

|

0.04

|

Trade receivables

|

168.00

|

166.96

|

181.40

|

108.90

|

195.89

|

Cash and cash equivalents

|

234.59

|

352.21

|

459.51

|

583.37

|

697.18

|

Other current assets

|

40.62

|

40.62

|

40.62

|

40.62

|

40.62

|

TOTAL

|

576.28

|

691.02

|

812.24

|

937.42

|

1069.02

|

Projected Income Statement for Next

5 Years

(Rupee in crores)

|

2016

|

2017

|

2018

|

2019

|

2020

|

INCOME

|

|||||

Total Operating Revenue

|

883.38

|

918.71

|

955.46

|

993.68

|

1033.48

|

Other income

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

Total Revenue

|

883.38

|

918.71

|

955.46

|

993.68

|

1033.48

|

EXPENSES

|

|||||

Operating Expense

|

698.97

|

726.93

|

756.00

|

786.24

|

817.69

|

Depreciation and amortization

expense

|

20.32

|

19.86

|

19.71

|

19.91

|

20.48

|

Other Expenses

|

0.00

|

0.00

|

0.00

|

0.00

|

0.00

|

Tax Expense

|

56.63

|

59.33

|

62.03

|

64.72

|

67.38

|

Total Expenses

|

775.91

|

806.11

|

837.74

|

870.86

|

905.55

|

Profit For the Year

|

107.46

|

112.60

|

117.72

|

122.82

|

127.87

|

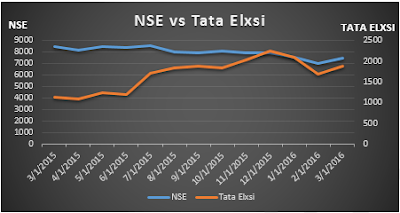

Price Performance

References

About the Author

This report has been prepared by Sahil Karodia and Uttam Khunt and

published by Jayant Gupta. They are pursuing MBA from Institute of Management,

Nirma University located in Ahmedabad, India.

Disclaimer

This document is solely for the personal information of the

recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or

financial advice. Each recipient of this document should make such

investigations as they deem necessary to arrive at an independent evaluation of

an investment in the securities of the companies referred to in this document

(including the merits and risks involved), and should consult their own

advisors to determine the merits and risks of such an investment.

The information in this document has been printed on the basis of

publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete

and it should not be relied on as such, as this document is for general

guidelines only.

Great Post. thanks for sharing..!!Online money transfer Provider

ReplyDeleteShare your personal details

ReplyDeleteAnd win validation code

Tell Schnucks Feedback in Customer Survey

Nice Article. Thank you for sharing the informative article with us.

ReplyDeleteThis post is helpful to many people. stockinvestor.in is a stock related website which provides all stocks related information like new stocks and shares available in the stock market.

traded stocks

market capitalization

At Schnucks, they understand that the customer’s feedback is critical to providing them with the best shopping experience.

ReplyDeletetellschnucks

Lane Bryant Credit Card Login, through its online platform, has made it easy for customers to manage their accounts from the comfort of their homes.lane-bryant-credit-card-login/

ReplyDeleteVisit www neighborhoodfeedback applebees com to share your dining experience and valuable feedback with Applebee’s www neighborhood feedback applebeescom

ReplyDelete